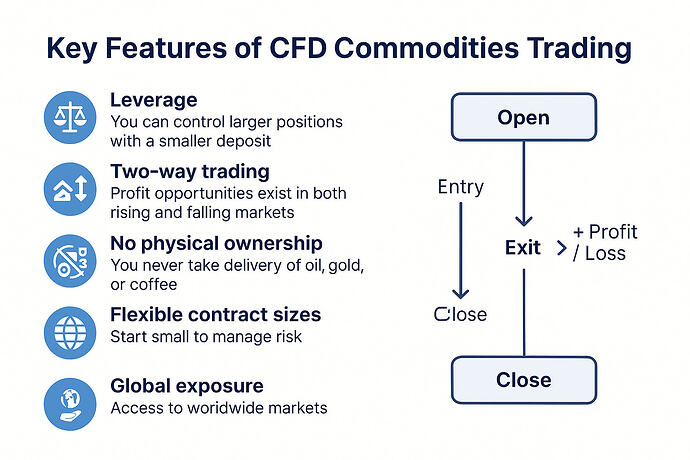

A CFD (Contract for Difference) is a financial derivative contract between you and a broker to exchange the difference in the price of an asset between when you open and close the trade. The concept applies to many assets, including forex, stocks, indices, and commodities. It is especially appealing because it allows you to trade rising and falling markets using leverage.

CFD trading allows traders to speculate on the price movements of financial markets without owning the underlying asset. Instead of buying a physical commodity or share, you trade based on whether you expect the price to rise or fall. This makes CFDs one of the most flexible and accessible forms of trading for both beginners and experienced traders.

Quick summary

-

CFDs let you speculate on market prices without owning the asset.

-

You can trade both directions: potential profit from rising or falling prices.

-

Leverage helps you control larger positions, but it also increases risk.

-

Deriv platforms like Deriv MT5 and Deriv cTrader, making CFD trading accessible to beginners.

-

Commodities, forex, and indices are among the most popular CFD markets.

READ THE FULL GUIDE HERE